A Union Budget that bets on growth

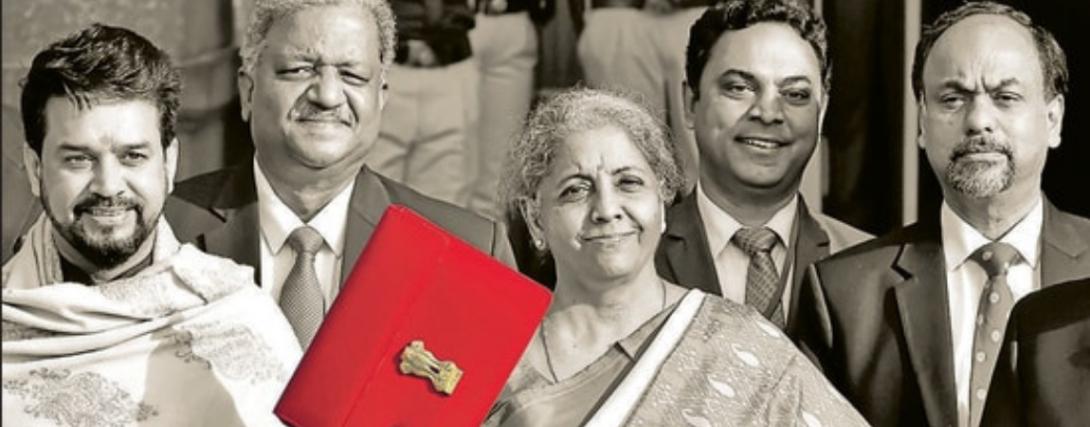

This is a landmark budget as it improves both ease of doing business and also ease of living for women. It attempts to minimise the regulatory and compliance burden imposed on the taxpayers, especially corporate taxpayers and facilitates the growth of MSMEs (Ajay Aggarwal /HT PHOTO)

The 2021-22 Union Budget has exceeded all expectations. This is reflected in the sharpest budget day rise in both the Nifty and Sensex since February 2001. The markets as well as the experts are cheering finance minister (FM) Nirmala Sitharaman’s boldness in focusing almost exclusively on accelerating growth and, thereby, generating large scale employment.

She has jettisoned the Fiscal Responsibility and Management Act’s import of fiscal conservatism. The budget has launched the economy on a virtuous cycle of growth, which will imply rising tax revenues, higher non-tax resource mobilisation, and ramping up credit flows from the banking and financial sectors to infrastructure, micro, small and medium enterprises (MSMEs), and agriculture. This will ensure that our debt-to-Gross Domestic Product (GDP) ratios will decline once the economy is on a higher growth path. The higher liquidity available in the banking sector will help absorb higher level of government borrowing, without stocking inflationary pressures or raising bond yields.

The 137% increase in the health sector outlays is a bold response to the pandemic’s requirement for improving the public health infrastructure. This higher outlay will be used to strengthen the existing health and system and also supporting 17,000 health and wellness centres in rural and 11,000 in urban areas. Over and above this, the budget also allocates ₹2.86 lakh crores for Jal Jeevan Mission in urban areas and ₹1.67 lakh crore for the Swachh Bharat Urban Mission over the next five years. This outlay will also help to improve health outcomes. The allocation of ₹2,027 crore for improving air quality in cities with more than one million population, and the introduction of voluntary scrappage policy, will help battle pollution. While allocating ₹35,000 crores for the roll-out of the vaccine programme, the FM was careful in pointing out that additional funds would be made available as and when required.

The highlight of the budget has been its laser-like focus on ramping up public capital expenditure for improving the physical infrastructure of the country. The budget allocates ₹5.54 lakh crore for capital expenditure — a 34% increase over the ₹4.12 lakh crore allocated in the previous year. If we include the additional ₹2 lakh crore to be transferred to the states for helping them raise their own capital expenditure, it represents a whopping increase of 70% over the previous year capital expenditure. This is unprecedented.

This capital expenditure will see the highest ever allocation of ₹1.08 lakh crore of capital expenditure for the ministry of road, transport and highways; ₹1.07 lakh crores for railways; ₹18,000 crores for public transport in urban areas; extension of city gas distribution system to another 100 cities; and higher allocation of inland waterways, ports and airports. This outlay on infrastructure projects will generate significant multiplier effects, thereby generating employment and faster growth in the coming years.

The budget has laid out a very ambitious package for raising non-tax revenue. For the first time, a concrete pipeline has been prepared with a dashboard for close monitoring for effective implementation. This effort will be supplemented by an active disinvestment programme, which will include several companies such as BPCL, Air India, Pawan Hans, CONCOR, SCI and BEML. Work on disinvestment is in an advanced stage and will be surely completed within this year. Its highlight is the inclusion of two public sector banks and one general insurance company, which are slated to be disinvested, and the listing of the Life Insurance Corporation, through an IPO, in the coming fiscal year. The FM has also announced the monetisation of surplus land holdings. All these together are expected to yield ₹1.75 lakh crore and will also ensure a larger space for private investors and entrepreneurs.

The budget proposes a number of structural reforms. These include establishing an independent pipeline operator; raising the foreign direct investment limit from 49% to 74% in the insurance sector so as to attract higher foreign capital inflows; establishing a development finance institute with a capital of ₹20,000 crore; setting up an Asset Reconstruction and Management company to help clean up the balance sheet of commercial banks so that they can start lending in full measures to various sectors in the economy; incorporating another 1,000 mandis in the e-Nam framework; expanding “operation green” to 22 perishable crops; establishing the higher education commission for implementing the reforms recommended by the New Education Policy; allocating ₹50,000 crore for the next five years to operationalise the national research foundation for encouraging front-line technologies in India; and complete exemption for senior citizens above 75 years for filing income tax returns.

This impressive list of structural reforms, though not exhaustive, will lay a strong foundation for the Indian economy to sustain high rates of growth and employment generation in the coming decade.

This is a landmark budget as it improves both ease of doing business and also ease of living for women. It attempts to minimise the regulatory and compliance burden imposed on the taxpayers, especially corporate taxpayers and facilitates the growth of MSMEs. This will ensure that the Indian manufacturing.

Dr Rajiv Kumar is Former Vice Chairman, NITI Aayog.

Views expressed are personal. This interview was published in Economic Times.

National Portal Of India

National Portal Of India