- Overview

- The Vertical is actively working towards deepening the reach of public-private partnerships as the preferred mode for the implementation of infrastructure projects. It seeks to create timebound world-class infrastructure and attract private sector and institutional capital in infrastructure.

- Core Functions

- The Vertical makes policy-level recommendations for institutional, regulatory and procedural reforms, and works towards the standardisation of PPP documents. It also provides transaction structure guidance to implementing agencies, evolves suitable reforms and policy initiatives for consideration of the Government, and appraises PPP projects. The Vertical develops concession-agreement guiding principles and/or model concession agreements in different sectors, and reviews and provides comments on the Central Government PPP projects via the PPPAC and/or SFC process. Various path-breaking initiatives aimed at promoting private and foreign direct investments in the infrastructure space are being undertaken by the Vertical.

- Appraisal of Central Government Public-Private Partnerships

- During the year 2020–21 (1 April 2020 to 31 March 2021), 125 PPP projects—with a total cost of Rs 1,72,314 crore—were appraised by the Vertical. This includes 123 Central Government projects and two State projects. The sector-wise distribution of the PPP projects (including the projects under the VGF scheme) appraised is given in the table below:

Project Appraised No. of Projects Total Cost (Rs in Crores) Roads

69

63,279

Ports

12

3,359

Eco-Tourism

10

2,232

Silos

1

401

Petroleum Reserves

4

27,728

Ropeway

1

996

Telecom

9

29,199

Railway Stations

6

7,600

Railway Passenger Trains

12

30,099

Metro

1

7,420

Total

125

1,72,314

- Asset Monetisation Initiative

- Investment-led growth is central to the economic agenda of the Government. One of the prerequisites of such growth is capital and asset recycling. In this context, asset recycling and monetisation hold the key to value-creation in infrastructure, by unlocking value from public investment and tapping into private-sector efficiencies for delivering infrastructure.

The Union Budget 2021 laid a significant thrust on infrastructure and asset monetisation as critical financing options for enhancing investment. The Budget strengthened the resolve of the Government for value creation and improvement in productivity of brownfield infrastructure assets such as toll roads, railways, transmission and pipelines through innovative instruments and laid a clear roadmap for monetisation of core assets.

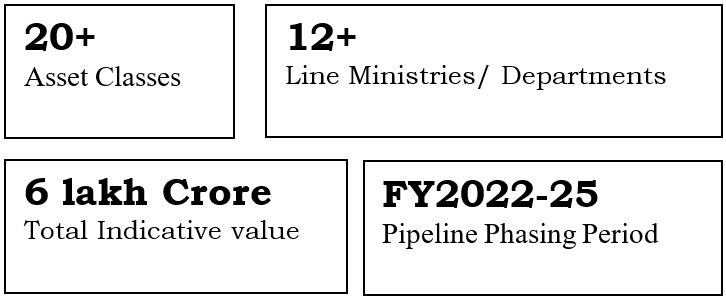

The strategic objective of the Asset Monetisation Programme is to unlock the value of investment in public assets for future developments while tapping into private-sector financing and efficiencies for delivering infrastructure services.

The PPP Vertical is steering the recycling and monetisation of various core infrastructure assets. To date, substantial ground has been covered in creating a sustained asset pipeline and rolling out structured and risk-managed transactions. Key achievements are set out as under:

- During May 2021, PGCIL successfully completed monetisation of its first batch of transmission assets and raised Rs 7,700 crore. POWERGRID InvIT is the first-ever public sector InvIT.

- NHAI’s InvIT has been approved and the transaction is in an advanced stage. The fund-raising process and unit placement are expected to be completed during FY 22.

- NHAI’s Toll-Operate-Transfer-based concessions are being successfully bid out with an encouraging response from the market. Four TOT bundles aggregating to 1400 km of toll roads in recent years have been awarded, successfully fetching aggregate proceeds of Rs 17,000 crore.

- The Airports Authority of India has successfully monetised 6 brownfield AAI airports—Chennai, Kolkata, Ahmedabad, Jaipur, Guwahati and Lucknow—through the OMDA model, raising upfront proceeds of Rs 900 crores towards concession fees and generating significant private investment towards augmentation of these airports.

- Indian Railways launched a strategic foray into PPP for private participation in the running of passenger trains. The bidding process for the first batch of 150 private passenger trains is underway, with a targeted investment of Rs 30,000 crore.

- The station redevelopment programme of the Railways has been launched on a significant scale and the bid process is underway for 12 stations, including iconic ones such as New Delhi and Chhatrapati Shivaji Maharaj Terminus (Mumbai), envisaging an aggregate investment of Rs 10,000 crore. An additional 40 station-redevelopment projects will be launched on the PPP mode.

NMP serves as a medium – term roadmap of the potential financing opportunities and drive preparedness of public sponsor as well as private sector/ institutional investors towards financing the infrastructure gap. The objective is to provide a platform for ministries to track asset performance and bring in greater efficiency and transparency in public assets management. To know more:

To know more:

VOLUME I: MONETISATION GUIDEBOOK | VOLUME II: ASSET PIPELINE - Other Marquee Initiatives and Projects

-

Redevelopment of Railway Stations through Public-Private Partnership

NITI Aayog has been working closely with the Ministry of Railways in fast-tracking the railway stations’ redevelopment programme across the country. As part of this endeavour, consultations have been undertaken with various stakeholders for the evaluation and redressal of challenges. A self-sustainable PPP-based model for the development of world-class stations has been finalised. NITI Aayog has engaged with the Ministry of Railways to finalise the concession terms and bidding documents, based on which bidding processes for 10 stations were initiated in FY2020–21.

Passenger Train Operation by Private Sector through Public-Private Partnership

NITI Aayog, along with the Ministry of Railways, is spearheading landmark reforms in passenger train operation through the PPP mode. Private participation in sourcing and operation of modern technology trains for better passenger experience is one such initiative. Pursuant to such efforts, the bidding process for 12 clusters on 109 origin destination pairs involving 150 trains has been undertaken.

Eco-Tourism Facilities through Public-Private Partnership

As part of NITI Aayog’s initiative for holistic development of islands, the bidding process for the development of sustainable eco-tourism projects in seven islands of Andaman and Nicobar and Lakshadweep has been undertaken. Several other islands have also been identified for development under the second phase of the project. To effectively facilitate development of such eco-tourism facilities, a model concession agreement has been formulated that can be suitably adopted, a copy of which can be accessed from the NITI Aayog website. The PPP Vertical has provided the required support to the UT administration in engaging consultants through competitive bidding for master-planning of the islands and timely structuring of PPP transactions.

Redevelopment of Jawaharlal Nehru (JLN) Stadium on PPP ModeNITI Aayog has been working closely with the Ministry of Youth Affairs and Sports in finalising the strategy for the redevelopment of the JLN Stadium in Delhi. The project is envisaged to be executed through the PPP mode by leveraging the mixed-use/real-estate development potential available around the stadium. The key objectives of this project are to promote the development of the stadium and develop the unutilised/underutilised spaces for complementary commercial activities to maximise revenue streams. NITI Aayog, along with the Ministry of Youth Affairs and Sports, undertook pre-feasibility analysis of the project to assess viability and initial feasibility through the PPP mode.

Ropeway-Based Public Transportation System via PPP ModeNITI Aayog has developed a Draft Model Concession Agreement for the development of ropeway projects through the PPP mode, a copy of which can be accessed from the NITI Aayog website under the Publications section. NITI Aayog had commissioned pre-feasibility studies for the development of ropeway-based public transport systems in Gangtok and Aizawl through the PPP mode. Scarcity of land in urban centres of hilly areas, along with steep road gradients limiting road expansion, is a major constraint in the development of public transport infrastructure. This creates pressure on the public transport system, with most commuters relying on taxis or private vehicles. A need for a planned public transport system was felt for cities such as Gangtok and Aizawl. Citing this need, NITI Aayog undertook pre-feasibility studies to assess the viability and initial feasibility through the PPP mode. Pursuant to these efforts, the Gangtok project is being structured on PPP mode.

Scheme for Inviting Private Investment in Medical Education

To address the shortage of qualified medical professionals, general practitioners and specialists, a scheme for attaching an existing district hospital to a medical college through the PPP mode has been developed by the Vertical. The unique PPP framework allows for synergy between the private and public healthcare sectors, capitalising on their respective strengths. The public sector has functional hospitals with rich clinical material, but lacks adequate resources, infrastructure and faculty base required for a medical college. The private sector on the other hand has investible capital, resources, required infrastructure and faculty, but lacks functional hospitals with the requisite clinical material (required as per the extant regulations). Accordingly, a PPP framework has been formulated that combines a government district hospital with an affiliated academic institution developed by a private partner. Under the proposed model, the district hospital is augmented into a teaching medical college as per the Government of India’s stipulated medical education regulatory norms with private sector investment. The combined project is to be operated and maintained by the private partner, as per the applicable norms, governed by a detailed concession agreement. The Vertical has developed the model concession agreement and model RFP for medical education during the current fiscal, a copy of which can be accessed from the NITI Aayog website under the Publications section.

Enhancement in Viability Gap Funding for Social Sector

Social infrastructure projects face viability concerns. Therefore, to boost private investments in social sector infrastructure, such as schools and hospitals, enhancement in viability gap funding (VGF) allocation for social sector projects was approved by the Ministry of Finance in the current fiscal. The PPP Vertical worked in close coordination with DEA, Ministry of Finance, in revising the guidelines as part of this strategic revamp of the VGF scheme. Under the scheme, the PPP projects will be proposed by Central Ministries, State Governments, and statutory entities. VGF of up to 30%, revised from the earlier limit of 20%, will be provided under the scheme for social sector infrastructure projects. This path-breaking reform will benefit PPP projects and provide a boost to private sector investment in social sector infrastructure creation. The revised guidelines for the scheme have been issued by DEA to the various Ministries and States during FY 20–21.

Model Concession Agreement for e-Buses

NITI Aayog has developed a model concession agreement for the operation and maintenance of electric buses in cities through PPP on operating expenses (OPEX) basis, a copy of which can be accessed from the NITI Aayog website under the Publications section. Under the proposed model, the private partner will be required to incur the necessary capital expenses (CAPEX) for procurement of e-buses and for O&M infrastructure, while the state transport authority will pay the operational expenses on per kilometre basis (also the bid parameter). The framework can be used to develop city-specific concessions to introduce e-buses and enable the Government’s plan to push zero-emission vehicles.

Guidelines for Stuck Highways Projects

NITI Aayog assisted the Ministry of Road Transport and Highways in developing the ‘Guiding Principles for Resolution of Stuck Projects’ under execution by MoRTH/NHAI/NHIDCL through BOT (Toll/Annuity/HAM), EPC, Item Rate. These guiding principles lay down the broad framework for resolution and settlement of cases of stuck projects via conciliation.

Model Concession Agreement for Automated Inspection and Certification (I&C) Centres for Transport Vehicles

Pursuant to the Motor Vehicles (Amendment) Act 2019 and the Ministry of Road Transport and Highways’ 2017–20 guidelines, testing and certification of vehicles’ fitness are envisaged only at automated-testing stations. To enable speedy and effective implementation of such projects, NITI Aayog developed the ‘Concession Agreement Guiding Principles for Setting Up and Operating Automated I&C Centres for Transport Vehicles’, a copy of which can be accessed from the NITI Aayog website. Under this model, the concessionaire will be required to incur the necessary CAPEX for setting up the I&C centre, including the requisite equipment, while the authority will incur a ‘fee per tested vehicle’ payable to the concessionaire (also, the bidding parameter). This PPP model—leveraging private-sector investment and efficiencies—will facilitate swifter implementation of the amended law, with faster proliferation of automated I&C centres, imbibing state-of-the-art technology that is being set up across the country.

Model Concession Agreement for Multimodal Logistic Parks

NITI Aayog, upon a request from the Department of Commerce, designed a model concession framework for ‘development of multimodal logistics parks (MMLPs) through PPP’ in view of the Department’s upcoming multimodal logistics parks policy. The model concession agreement proposes grant of concession through BOT (Built Operate Transfer), for setting up and operating multimodal freight-handling facility, comprising mechanised warehouses with intermodal transfer facilities and offering value-added services. This will, eventually, lead to a network of MMLPs in the country to ensure a seamless transfer of goods across modes.

- Reports

-

Title Download Stakeholders Consultation - Draft MCA for Public Private Partnership in Ropeways

- Who’s Who

-

Name Designation Email Sh. Ch. P. Sarathi Reddy Adviser ps[dot]reddy[at]gov[dot]in Ms. Nidhi Arora Consultant Grade II arora[dot]nidhi[at]nic[dot]in Sh. R.K. Bhatheja Research Officer rk[dot]bhatheja[at]nic[dot]in Sh. Sanju Yadav Young Professional sanju[dot]yadav18[at]nic[dot]in Ms. Manpreet Kaur Young Professional k[dot]manpreet[at]govcontrator[dot]in Ms. Mansi Sharma Young Professional mansi[dot]sharma[at]nic[dot]in Ms. Kriti Pradhan Young Professional kriti[dot]pradhan[at]gov[dot]in Ms. Anneka Majhi Young Professional anneka[dot]majhi[at]nic[dot]in

Public Private Partnerships

National Portal Of India

National Portal Of India